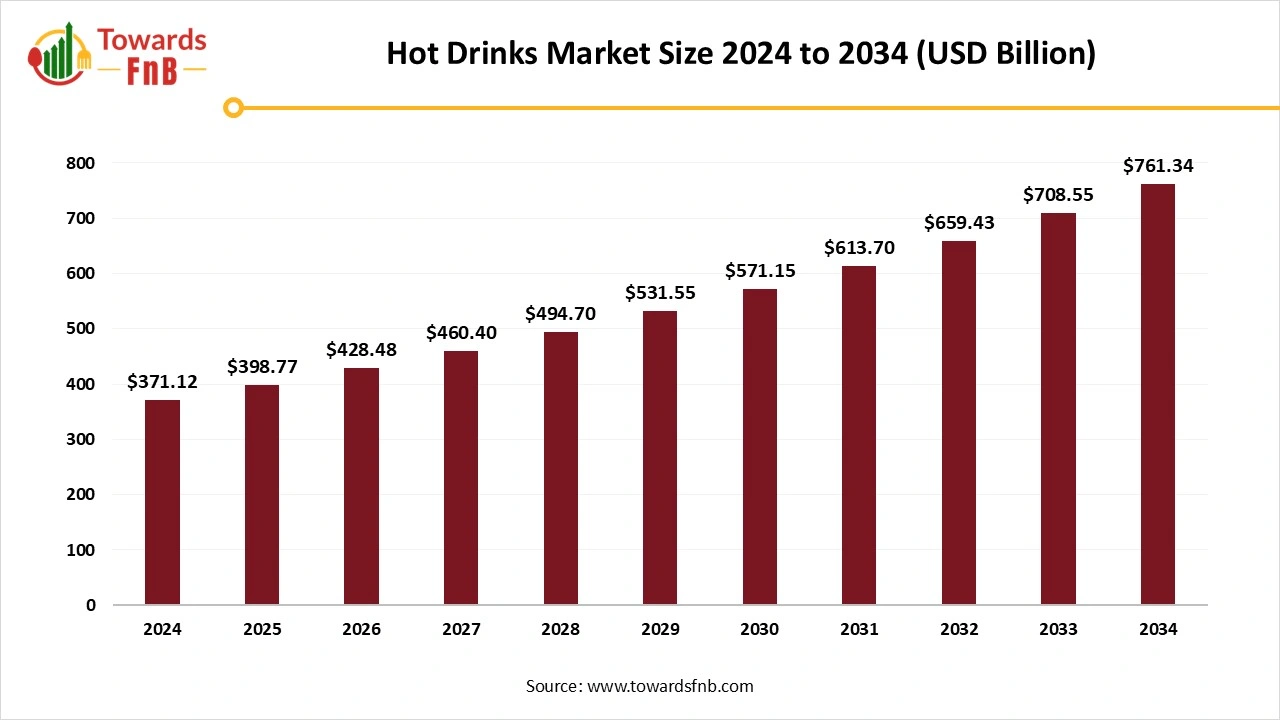

Hot Drinks Market Size to Worth USD 761.34 Billion by 2034, Growing at 7.45% CAGR | Towards FnB

According to Towards FnB, the global hot drinks market size is calculated at USD 398.77 billion in 2025 and is forecasted to hit around USD 761.34 billion by 2034, advancing at a CAGR of 7.45% during the forecast period 2025 to 2034. Rising demand for premium coffee pods, functional teas, and sustainable packaging is reshaping consumer habits across age groups and regions.

Ottawa, Sept. 29, 2025 (GLOBE NEWSWIRE) -- The global hot drinks market size stood at USD 371.12 billion in 2024 and is anticipated to increase from USD 398.77 billion in 2025 to reach nearly USD 761.34 billion by 2034, at a CAGR of 7.45% from 2025 to 2034, according to study published by Towards FnB, a sister firm of Precedence Research.

The market has been growing in recent periods due to high demand for various types of hot beverages, including tea, coffee, green tea, lemon tea, and other forms of hot beverages. A growing culture of coffee shops and cafes among young people is also contributing to the growth of the hot drinks market.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5844

Key Highlights of the Hot Drinks Market

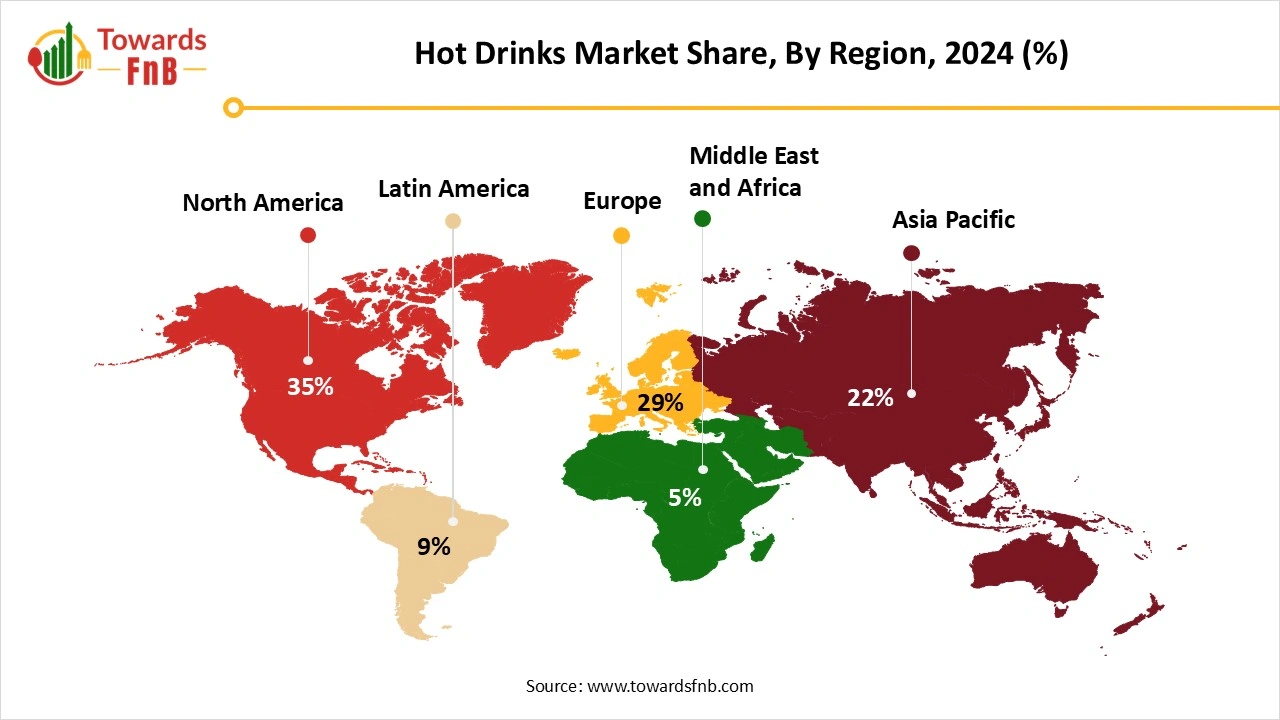

- By region, North America led the hot drinks market with the highest share of 35% in 2024, whereas the Asia Pacific is expected to grow at a notable rate in the forecast period.

- By product type, the ground/roasted coffee segment captured the maximum share of 40% in 2024, whereas the ready-to-drink segment is expected to grow in the foreseeable period.

- By formulation, the powder/granules segment led the hot drinks market with largest share of 50% in 2024, whereas the sachets/pods segment is expected to grow in the expected timeframe with the highest CAGR.

- By distribution channel, the supermarkets/hypermarkets segment dominated the hot drinks market with highest share of 45% in 2024, whereas the online/e-commerce segment is expected to grow in the forecast period.

- By end user, the household consumer segment captured the maximum share of 50% in 2024, whereas the foodservice and hospitality segment is expected to grow in the foreseeable future.

Premium and Specialty Drinks leading to High Demand for Hot Drinks

The hot drinks market showcases a high demand for a diverse range of hot beverages globally, including tea, coffee, green tea, hot chocolate, herbal infusions, and flavored teas. The global hot drinks market is expected to grow due to enhanced consumer preferences and increased spending power. Such beverages are consumed by consumers ranging in different age groups. A growing culture of coffee shops and cafeterias is another aiding factor in the growth of the hot drinks market. Consumers like to socialize at such places with a relaxed atmosphere and with good company. Millennials and Gen Z prefer to visit such places and hence have a major role in the growth of the hot drinks market.

For Instance, Premium pods (Nespresso, Keurig) and specialty tea brands (Ahista, Dilmah, Tata Tea Premium) are gaining traction as consumers are willing to pay a 20–30% higher price per unit for convenience, quality, and storytelling.

New Trends in the Hot Drinks Market

- High demand for vitamins and mineral-infused tea and other hot beverages is helping the hot drinks market grow. Hence, such tea and beverage manufacturers collaborate with cafeterias for enhanced sales and to satisfy consumer demands.

- High demand for hot, fancy beverages such as matcha, flavored coffees and teas, and vitamin-infused teas, as well as functional drinks, has also contributed to the market's growth. The high demand for sustainable and plant-based beverage options has also fueled the market's growth.

- Cafeterias with eco-friendly practices, such as the use of reusable cups, compostable lids, and waste reduction efforts, are highly preferred by consumers due to rising awareness, which is helping drive the growth of the hot drinks market.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/hot-drinks-market

Recent Developments in the Hot Drinks Market

- In May 2025, Faerch, a food packaging provider, launched its latest hot beverage lid made from recycled polyethylene terephthalate (rPET) plastic. The lids are designed to help businesses enhance their brand reputation while responding to evolving consumer demands. (Source- https://www.packaging-gateway.com)

- In September 2025, Oatly, an oat milk brand, launched its limited hot cocoa oat milk product in the US due to the upcoming festive season. (Source- https://www.foodbev.com)

Hot Drinks Consumption Places and Age Brackets

| Age of Consumers | ||||||

| Places for Hot Drinks Consumption | 18-24 | 35-44 | 55-64 | |||

| At Home | 63.3 | % | 75.4 | % | 87.9 | % |

| Coffee shops/Cafeterias | 63.9 | % | 48.7 | % | 32.2 | % |

| Convenience Stores | 42.9 | % | 41.2 | % | 20.7 | % |

| Workplace | 22.4 | % | 30.7 | % | 13.2 | % |

| Online/E-commerce Platforms | 10.9 | % | 15.6 | % | 1.1 | % |

| Other | 0.0 | % | 0.0 | % | 1.1 | % |

(Source- https://www.askattest.com)

The data above represents the percentage of hot drinks and beverages purchased from different platforms in the US. The young generation, aged 18-24, prefers to purchase their hot beverages from coffee shops and convenience stores, whereas the middle-aged segment, aged 35-44, prefers to obtain their hot beverages from the workplace.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5844

Hot Drinks Market Dynamics

What are the growth drivers of the Hot Drinks Market?

The high demand for various types of functional drinks, plant-based beverages, vitamin-infused teas, hot chocolates, and other forms of hot beverages has contributed to the growth of the hot drinks market. Millennials and Gen Z, with a high preference for cafeterias and coffee shops, have also contributed to the growth of the hot drinks market. High demand for organic and premium coffees and various other hot drinks has also fueled the market’s growth. Rising disposable income, changing consumer preferences, and high demand for various types of hot drinks among consumers of different age groups have also contributed to the market's growth.

Challenge

Supply Chain Issues Restraining Market Growth

Fluctuating prices of raw materials such as green tea leaves, coffee beans, and various other ingredients result in high prices of the final product, which obstructs the growth of the hot drinks market. Geopolitical issues, climatic factors, higher operational expenses, and various other factors also impact the market's growth.

Opportunity

Flavor Introduction: Burgeoning Market’s Growth

The introduction of different types of flavors in hot drinks is a major factor driving the growth of the hot drinks market. Such products enable consumers to enjoy a variety of hot drinks and beverages that contain high nutritional elements, including vitamins and minerals. Hence, such drinks help consumers to improve their overall health. Such drinks are also available in low-sugar, low-calorie, and unique flavors, further helping the growth of the market.

Hot Drinks Market Regional Analysis

North America dominated the Hot Drinks Market in 2024

North America led the hot drinks market in 2024, driven by high demand for coffee and other hot beverages in the region. The US, Canada, and Mexico make a significant contribution to the regional market's growth, thanks to a high number of coffee consumers in coffee shops and cafeterias, which is beneficial for market growth. High demand for lattes, cappuccinos, espresso, and strong brews in the region is another key factor driving the market's growth. The multiple health benefits of such drinks also fuel the growth of the hot drinks market in the region.

Asia Pacific is expected to grow in the Forecast Period.

Countries like India and China have made a significant contribution to the growth of the hot drinks market in the Asia Pacific, which is expected to continue growing in the foreseeable future. Rising disposable income, high demand for hot drinks and beverages, and urbanization are key factors driving the market's growth in the region. Growing culture of cafeterias and coffee shops, along with ready-to-drink coffees, is also helping the market grow in the foreseeable period. The high demand for such drinks at social events, ceremonies, and gatherings is also contributing to the market's growth.

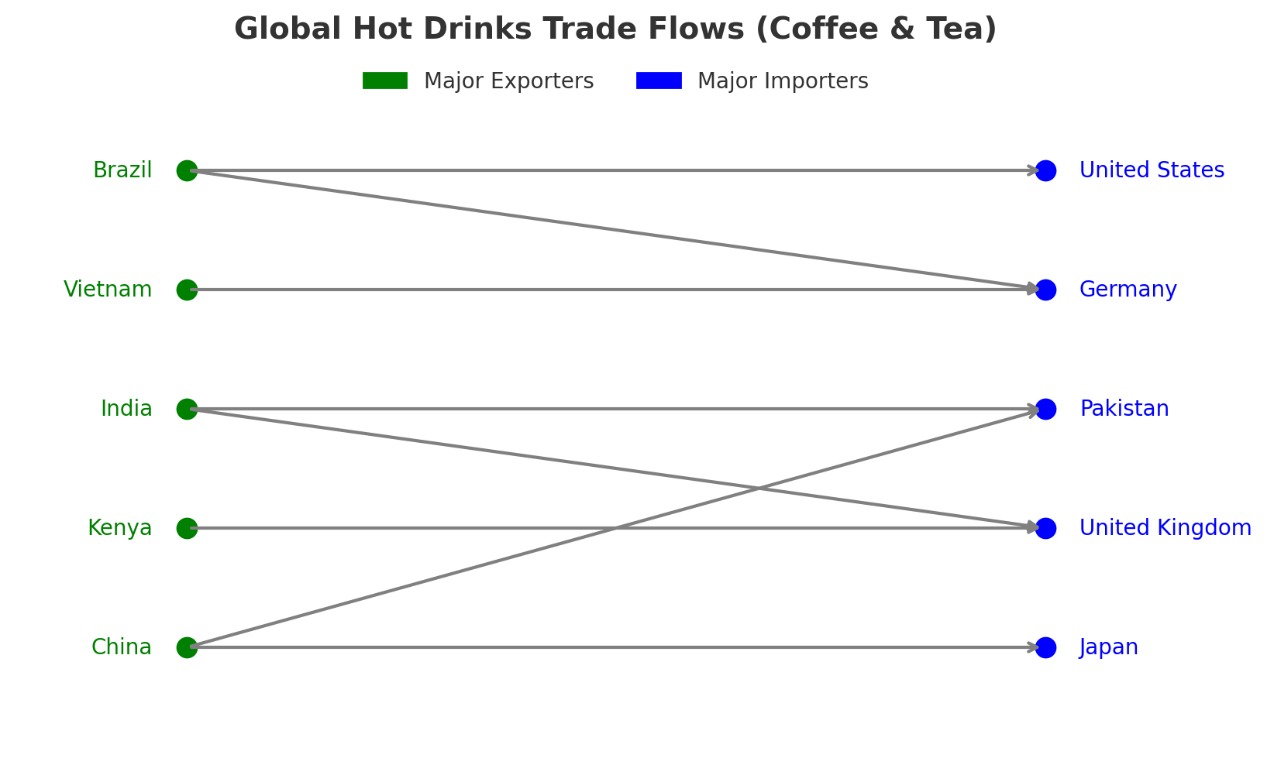

Global Trade Analysis – Hot Drinks

International trade plays a pivotal role in shaping the global hot drinks market, with coffee and tea being the most widely traded products. Exporting countries such as Brazil, Vietnam, India, and Kenya are critical suppliers to consumer-driven markets like the United States, Germany, and the United Kingdom. Re-export hubs including Switzerland and Germany further add value through roasting, blending, and packaging before distributing to global markets.

The tables below highlight the leading exporters of coffee and tea in 2024:

Top Coffee Exporting Countries, 2024

| Rank | Country | Export Value (USD, 2024 est.) (Approximate) | Key Notes |

| 1 | Brazil | 7.35 billion | Largest global exporter of Arabica coffee |

| 2 | Vietnam | 3.38 billion | Dominant in Robusta coffee exports |

| 3 | Colombia | 2.8 billion | Premium Arabica supplier |

| 4 | Ethiopia | 1.5 billion | Specialty and origin-based coffee leader |

| 5 | Indonesia | 1.3 billion | Mix of Arabica & Robusta exports |

| 6 | Honduras | 1.2 billion | Increasing presence in specialty markets |

| 7 | India | 1.1 billion | Strong instant and blended coffees |

| 8 | Germany | 1.0 billion | Re-exports after roasting & packaging |

| 9 | Switzerland | 0.9 billion | Re-export hub for Nespresso and premium brands |

| 10 | Peru | 0.8 billion | Organic and specialty coffee focus |

Top Tea Exporting Countries, 2024

| Rank | Country | Export Value (USD, 2024 est.) (Approximate) | Global Share (Approximate) | Key Notes | |

| 1 | China | 2.7 billion | 27 | % | Strong in green tea and herbal teas |

| 2 | India | 1.7 billion | 18 | % | Major supplier of black tea |

| 3 | Kenya | 1.5 billion | 15 | % | Leading exporter of black CTC teas |

| 4 | Sri Lanka | 1.4 billion | 14 | % | Known for premium Ceylon teas |

| 5 | Vietnam | 0.5 billion | 5 | % | Focus on both black and green teas |

Hot Drinks Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 7.45% |

| Market Size in 2025 | USD 398.77 Billion |

| Market Size in 2026 | USD 428.48 Billion |

| Market Size by 2034 | USD 761.34 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Hot Drinks Market Segmental Analysis

Product Type Analysis

The ground/roasted coffee segment led the hot drinks market in 2024, driven by high demand for premium coffees among consumers across all age groups. Roasted coffees, which add more volume and body to the blend, are another major factor contributing to the segment's growth and fueling the market’s expansion. High demand for quality coffees is another major factor for the market’s growth. Ground coffees with intense flavors also help the market to enhance its growth.

The ready-to-drink coffee segment is expected to grow in the foreseeable future due to its convenience, which aids the lifestyles of busy consumers. They can be easily purchased from any convenience store or from online platforms and consumed directly. They are also easy to carry, allowing the market to grow in the foreseeable period. Such coffees are tasty and offer various nutritional benefits, further fueling the market’s growth. Hence, the segment is observed to grow in the foreseen period.

Formulation Analysis

The powder/granules segment led the hot drinks market in 2024 due to its unmatched convenience and formulations helpful for the growth of the hot drinks market. The segment enables consumers to easily carry the ingredients of hot drinks and prepare them on the go, whether outdoors or while traveling. Such ingredients also help enhance the flavors of hot drinks, making them a perfect blend and further fueling the market’s growth. They are also cost-effective, have longer shelf life, and are convenient to carry, which is helpful for the market’s growth.

The sachets/pods segment is expected to grow in the forecast period due to its convenience and ease of use, allowing more consumers to adopt the segment. Hence, the segment has a huge role in the growth of the market in the foreseeable period. They are easy to use, easy to carry, and allow consumers to use them anywhere and at any time, enabling them to use them frequently. Sachets and pods have a distinct flavor profile and are therefore highly sought after by millennials and Gen Z, contributing to the market’s growth.

Distribution Channel Analysis

The supermarkets/hypermarkets segment led the hot drinks market in 2024 due to the increased availability of these stores in residential areas. They have separate sections for different types of products, allowing consumers to shop for different products with ease. Different types of hot drinks, stacked in various sections, attract consumers, which is one of the major growth factors helping the market. Hence, such stores play a significant role in driving market growth.

The online/e-commerce segment is expected to grow in the foreseeable future due to the availability of various products easily. Such platforms offer a variety of products in different flavor profiles, which is beneficial for the market's growth in the foreseeable future. Consumers can also take advantage of heavy discounts and offers on these platforms to attract more customers.

End User Analysis

The household segment led the hot drinks market in 2024, driven by high consumption of hot drinks and beverages within domestic households globally. The high demand in the household segment, driven by everyday activities, relaxation time, and enhanced social interaction, is another major factor contributing to the market’s growth. High demand for less-sugar, low-calorie, and plant-based hot drinks and beverages at the household level is another major factor driving the growth of the hot drinks market.

The foodservice and hospitality segment is expected to grow in the foreseeable future due to the increasing popularity of cafeterias and coffee shops globally. Millennials' and Gen Z's preference for hot drinks and beverages is another major factor driving the growth of the segment, contributing to market expansion. The availability of various innovative hot drinks and beverages in diverse flavor profiles also contributes to market growth. The availability of plant-based, low-sugar, functional, and organic beverages in cafeterias and coffee shops also helps drive growth in the hot drinks market.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Food and Beverages Market: The global food and beverages market size is forecasted to reach from USD 8.71 trillion in 2025 to USD 14.72 trillion by 2034, expanding at a CAGR of 6% during the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size was valued at USD 165.28 billion in 2024 and is expected to grow steadily from USD 173.71 billion in 2025 to reach nearly USD 271.80 billion by 2034, with a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Vegan Food Market: The global vegan food market size is anticipated to grow from USD 22.38 billion in 2025 to USD 55.88 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Meal Kits Market: The global meal kits market size is projected to rise from USD 17.11 billion in 2025 to approximately USD 58.8 billion by 2034, registering a CAGR of 14.7% during the forecast period from 2025 to 2034.

- Soft Drink Concentrates Market: The global soft drink concentrates market size is projected to expand from USD 40.06 billion in 2025 to USD 53.75 billion by 2034, growing at a CAGR of 3.32% during the forecast period from 2025 to 2034.

- Baking Ingredients Market: The global baking ingredients market size is projected to grow from USD 18 billion in 2025 to around USD 31.72 billion by 2034, at a CAGR of 6.5% during the forecast period from 2025 to 2034.

- Sauces, Dressings and Condiments Market: The global sauces, dressings and condiments market size is anticipated to grow from USD 183.55 billion in 2025 to USD 294.67 billion by 2034, with a CAGR of 5.4% during the forecast period from 2025 to 2034.

-

Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.50% throughout the estimated timeframe from 2025 to 2034.

Top Companies in the Hot Drinks Market:

- PepsiCo – Expands into hot drinks through partnerships and ready-to-drink coffee and tea offerings.

- Coca-Cola – Active in hot beverages via brands like Costa Coffee and Honest Tea.

- Nestlé SA – Global leader in hot drinks with iconic brands like Nescafé, Nespresso, and Milo.

- Anheuser-Busch InBev SA/NV – Diversifying beyond beer with interest in ready-to-drink and functional hot beverages.

- Heineken N.V. – Primarily a brewer, but exploring diversification into non-alcoholic and wellness drink segments.

- Suntory – Japanese beverage giant producing bottled teas, coffee drinks, and functional hot beverages.

- Ahista Tea – Premium Indian artisanal tea brand specializing in slow-brewed and luxury hot teas.

- Diageo – Alcoholic beverage leader with growing portfolio in premium coffee and tea-based drinks.

- Unilever – Major tea company with brands like Lipton and PG Tips, along with herbal infusions.

- Asahi Group Holdings Ltd – Expanding from beer into coffee and tea products in Asian markets.

- Bisleri – Known for packaged water in India, also present in functional hot drink innovations.

- Constellation Brands – Alcohol giant exploring wellness and non-alcoholic beverages, including hot drink adjacencies.

- Dabur – Indian FMCG company producing Ayurvedic-based hot drinks like Chyawanprash-infused beverages.

- Danone SA – Offers hot drink adjacencies through dairy-based and health-focused beverages.

- Hector Beverages – Indian company behind Paper Boat, also offering traditional hot drink mixes.

- Keurig Dr Pepper – Known for Keurig single-serve coffee systems and hot drink pods.

- Monster Beverage – Primarily energy drinks, but diversifying into functional coffee and tea-based drinks.

- Monster Energy – Brand under Monster Beverage, introducing ready-to-drink coffee-energy blends.

- Parle Agro – Indian beverage company with emerging products in hot drink and wellness categories.

- Pernod Ricard – Global alcohol major with investments in premium coffee and tea liqueur-based hot beverages.

- Starbucks Corporation – World’s largest coffeehouse chain and major global hot beverage leader.

- Red Bull – Energy drink giant, exploring functional hot beverage innovation in select markets.

Segments Covered in the Report

By Product Type

- Coffee

- Instant Coffee

- Ground / Roasted Coffee

- Coffee Pods / Capsules

- Ready-to-Drink Coffee

- Tea

- Black Tea

- Green Tea

- Herbal & Specialty Tea

- Tea Bags / Loose Leaf

- Hot Chocolate / Cocoa

- Herbal & Infusions

- Others

By Formulation/Format

- Powder / Granules

- Liquid Concentrate

- Ready-to-Drink (RTD)

- Sachets / Pods

- Others

By Distribution Channel

- Supermarkets / Hypermarkets

- Convenience Stores

- Online / E-Commerce

- Cafes / Restaurants / Foodservice

- Specialty Retail Stores

By End User

- Household Consumers

- Offices / Corporate Canteens

- Foodservice & Hospitality

- Institutional / Educational Facilities

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5844

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies |

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Yogurt Market: https://www.towardsfnb.com/insights/yogurt-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Food Additives Market: https://www.towardsfnb.com/insights/food-additives-market

➡️Baking Ingredients Market: https://www.towardsfnb.com/insights/baking-ingredients-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Dairy Processing Equipment Market: https://www.towardsfnb.com/insights/dairy-processing-equipment-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Organic Food Market: https://www.towardsfnb.com/insights/organic-food-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Dietary Supplements Market: https://www.towardsfnb.com/insights/dietary-supplements-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Frozen Food Market: https://www.towardsfnb.com/insights/frozen-food-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.